With the new year nearly a quarter finished, a variety of trends and themes have already started to make themselves known. For the normally sleepy municipal bond sector, these trends have created a pretty volatile and difficult environment to navigate. Tailwinds and headwinds have churned the seas of the normally calm waters of state and local government credit. There are crosswinds for sure.

For investors with big positions in muni bond holdings, reducing these stormy seas is paramount.

Luckily, there are ways to navigate these crosswinds and potentially finish the year with some gains, all while collecting income. With these strategies in mind, munis can go back to being a boring, income generator for a portfolio.

A Churning Sea

Municipal bond investors are a relatively conservative lot. Bonds issued by state and local governments tend not to bounce around too much and their investors sit back while collecting their coupon payments. With that in mind, the current muni environment is looking a bit rough.

Total returns for the fixed income asset class clocked in at positive 1.9% for all of 2024. Given the 4% yields on many muni bond indexes, that implies the bonds’ prices managed to decline and yield/coupons managed to deliver the positive performance.

The reasons for the price declines are a mixture of economic and geopolitical issues.

For starters, municipal bonds may lose their tax-exempt status. Many lawmakers are looking to expand portions of the Tax Cuts & Jobs Act as the bill sunsets this year. However, burgeoning deficits from the bill and potential tax cuts mean tax increases elsewhere might need to be proposed. That has munis’ tax-exempt status now in question and potentially in the crosshairs. Given the uncertainty and quickly changing policy points the Trump Administration is known for, many muni bond buyers and holders have begun selling.

At the same time, tariffs and continued rising inflationary pressures have started to impact long-term bonds once again. The Federal Reserve might need to raise rates to combat the inflationary pressures. This has put munis under an additional lens as they often have longer maturities and durations.

Issuances of muni bonds have also increased in recent quarters as many states have taken advantage of lower current rates to fund their balance sheets and issue debt more cheaply.

And yet, these headwinds have been met with some very strong tailwinds propelling the muni sector.

That includes some of the highest starting yields in years. According to investment manager and muni bond specialist, Nuveen, municipal yields started 2025 at the highest level in nearly 15 years. Right now, muni bonds are yielding 122 basis points above their 20-year trailing average.

Moreover, the after-tax yield is substantially higher versus Treasury bonds, even if we were to account for taxes in that yield and the potential for the sector to lose its tax-exempt status. This chart from Goldman Sachs highlights the spread.

Source: Goldman Sachs

Then there is the state’s health as well. Balance sheets and rainy-day funds are still robust, while prudent budget management has continued to pay off. This has enhanced the credit quality of muni bonds.

Calming the Waters

So, on the one hand, muni investors have faced potentially nasty woes across tax status, geopolitical issues, and rising inflationary pressures. On the other hand, they are currently offering some of the fattest yields and strongest credit profiles in nearly two decades. Trying to balance the positives of the sector versus some of the negatives is a fine line to walk. But there are ways to do that.

According to AllianceBernstein, there are four strategies investors can follow to navigate the crosswinds and add ballast to their municipal bond boat.

Step one could be to selectively extend your duration. By going out on the yield curve, investors can take advantage of falling yields when they come or help clip more income today. If things right themselves and the Fed can once again start cutting rates as originally predicted, bond prices on the long end of the curve will rise. If they are forced to keep rates the same for a while, investors can clip more income from these bonds.

But by going long, investors are exposed to duration risk. This is why AllianceBernstein also recommends a barbell strategy, which combines short- and long-term maturity bonds. This allows investors to have their cake and eat it too. The short-term bonds protect against rising rates, while the long-term bonds protect against falling. According to AllianceBernstein, a barbell strategy would have market-beating returns last year.

Third, investors should look beyond investment-grade munis for returns. The high-yield market has long been a source of outsized yields at only slightly higher-risk profiles. Non-investment grade, BBB-, and A-rated bonds currently have yields of nearly 6%. However, many so-called high-yield munis still offer strong credit profiles and additional riders for repayment.

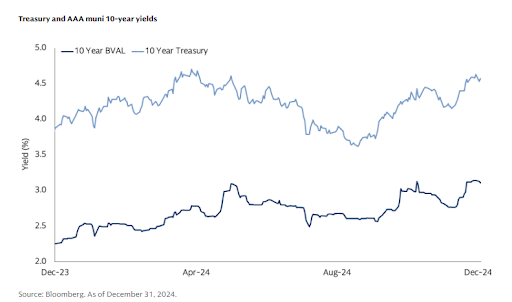

Finally, AllianceBernstein recommends staying flexible. The relationship between high-grade municipals and U.S. Treasuries is often changing. This relationship has long signaled great items to buy munis for strong total returns. Being more active with your muni bond portfolio could pay off and provide a way to lower volatility in the new year.

Navigating the Crosscurrents

Given the strong yield appeal and potential for gains, munis are still a top draw. But investors need to work toward navigating the headwinds. Following AllianceBernstein’s advice and using duration as a tool, as well as being selective in credit, barbelling, and timing purchases, makes a lot of sense. Luckily, there are plenty of ways to achieve a portfolio under this framework. ETFs can make short work of this.

For example, the VanEck Long Muni ETF and SPDR Nuveen Bloomberg Short-Term Municipal Bond ETF could be paired for a barbell strategy. An active ETF could be used to find opportunities, while investors could overweight a high-yield muni ETF to gain credit exposure. The idea is not to be static and simply buy a broad muni index and ride out the waves.

Active Municipal Bond ETFs

These ETFs were selected based on their ability to provide low-cost and active exposure to the municipal bond market. They are sorted by their YTD total return, which ranges from 0.4% to 1.6%. They have expense ratios between 0.12% and 0.65% and assets under management of $128M to $2.6B. They are currently yielding between 2.5% and 4.4%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SHYM | iShares High Yield Muni Income Active ETF | $295M | 1.6% | 4.4% | 0.46% | ETF | Yes |

| CGMU | Capital Group Municipal Income ETF | $2.59B | 1.2% | 3.4% | 0.27% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.75B | 1.2% | 3.2% | 0.35% | ETF | Yes |

| SMMU | PIMCO Short Term Municipal Bond Active ETF | $630M | 1.2% | 2.9% | 0.35% | ETF | Yes |

| IMNU | iShares Intermediate Muni Income Active ETF | $244M | 1.2% | 3.6% | 0.30% | ETF | Yes |

| MEAR | iShares Short Maturity Municipal Bond Active ETF | $733M | 1% | 3.1% | 0.25% | ETF | Yes |

| VCRM | Vanguard Core Tax-Exempt Bond ETF | $128M | 0.8% | 3.1% | 0.12% | ETF | Yes |

| DFNM | Dimensional National Municipal Bond ETF | $1.42B | 0.7% | 2.5% | 0.19% | ETF | Yes |

| FMB | First Trust Managed Municipal ETF | $2.04B | 0.6% | 3.3% | 0.65% | ETF | Yes |

| TAXF | American Century Diversified Municipal Bond ETF | $508M | 0.4% | 3.6% | 0.29% | ETF | Yes |

Passive Municipal Bond ETFs

These funds were selected based on their exposure to municipal bonds at a low cost. They are sorted by their YTD total return, which ranges from 0.2% to 1.1%. They have expense ratios between 0.03% and 0.35% and assets under management between $2.8B and $42B. They currently offer yields between 2.7% and 4.4%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.65B | 1.1% | 2.7% | 0.20% | ETF | No |

| HYMB | SPDR Nuveen Bloomberg High Yield Municipal Bond ETF | $2.86B | 0.9% | 4.4% | 0.35% | ETF | No |

| MUB | iShares National Muni Bond ETF | $41.1B | 0.2% | 3.2% | 0.05% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $39B | 0.2% | 3.3% | 0.03% | ETF | No |

All in all, the municipal bond sector has plenty of potential, but also plenty of headwinds. For investors, navigating those issues can lead to plenty of strong returns as the market plays out. By being selective, barbelling, and looking at credit opportunities, investors can make the most of the current muni sea and win.

The Bottom Line

Municipal bonds have been pretty volatile over the last few months. And many of the trends creating that volatility haven’t stopped. But investors shouldn’t give up hope. There are ways to play the muni market and profit.